Ad Get Your Sellers Permit for Only 6995. Bidding stops to obtain the tax.

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Ad Get New Jersey Tax Rate By Zip.

. Workers compensation premiums 225. About Annual Tax Sales. A day or two before the sale at the latest you must submit a deposit of at least 10 percent of the amount you plan to bid at the tax sale.

545-1 to -137 a. A sales tax certificate can be obtained by registering online through the Division of Revenue and Enterprise Services or by mailing in the NJ-REG form. Sales and Use Tax.

The New Jersey Supreme Court in In re. Princeton Office Park LP. Pay your initial deposit.

This post discusses only those tax sale foreclosures completed by individual non-municipal TSC holders. Electronic Municipal Tax Sales Online LFN 2018-08 Adoption of NJAC 533-11 creating regulations for long standing PILOT program for internet-based tax sales. Wages and hours subject to the New Jersey State Wage Collection Law.

The municipality will enforce the collection of those charges by offering same for sale which will cause a Tax Lien Certificate to be sold and filed. 18 or more depending on penalties. Purchasing a tax sale certificate is a form of investment.

If for any insurance company the ratio of New Jersey business to total business is greater than 125 the tax is imposed on only. Quickly Apply Online Now. Contracts considered professional service.

When prior years. Here is a summary of information for tax sales in New Jersey. New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of.

545-113 Private sale of certificate of tax sale by municipality. The attorneys at McLaughlin Nardi are well versed in tax sale certificate and tax sale foreclosure law. Discretion of tax collector as to sale.

Plymouth Park Tax Services LLC determined that under the Tax Sale Law NJSA. Free Unlimited Searches Try Now. New Jersey is a good state for tax lien certificate sales.

Thats 5000 lien amount 200. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New Jersey law. Recording of assignments service on tax collector.

Its the only state where the interest rate on the certificate amount is bid down to 0 and then premium is bid. If you bid premium and most liens in New Jersey are won at high premiums you dont get any interest on the certificate amount however you do get interest on the subsequent. Ad Free Training Course From US Tax Lien Association - Learn How To Buy Tax Liens.

Fast Easy and Secure Online Filing. If you are served with a foreclosure complaint or wish to pursue a claim on a tax sale certificate please call us at 973 890-0004 or e-mail us to see how we can assist you. In order to redeem the lien the property owner must pay the certificate amount plus the redemption penalty and the subsequent tax amount at 24.

When a municipality has or shall have acquired title to real estate by. Nj tax sale certificate premium Monday February 14 2022 Edit. New Jersey is really a different animal.

2016 and prior. Sales and Use Tax. If you invest in tax sale certificates be mindful of the complexities of the governing state law when you file a bankruptcy proof of claim on account of the certificate.

Elements of Tax Sales in New Jersey New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent. In NJ the lenders policy expense is only. Sales and Use Tax.

Lands listed for sale. Interest accrues on a tax sale certificate at the rater of 2 per month or a. The procedures that govern tax foreclosure are set down in the Tax Sale Law NJSA.

Up to 25 cash back In New Jersey once a tax lien is on your home the collector on behalf of the municipality can then sell the property at a public auction subject to your right of. The Plaintiff in a tax sale foreclosure. Skip the Lines Apply Online Today.

As with any governmental activity involving property rights the process is not simple. Sales and Use Tax. As a statutory officer of the State of New Jersey the tax collector is obligated to follow all state statutes regarding property tax collection including billing due.

If the interest is bid down to 1 a premium is bid up until the bidding stops to obtain the tax sale certificate. New Jersey Sales and Use Tax Energy Return. Select A Year.

Residential Property Tax Solutions Corelogic

Online Sales Tax Compliance Ecommerce Guide For 2022

Real Estate Related Services Design De Arte

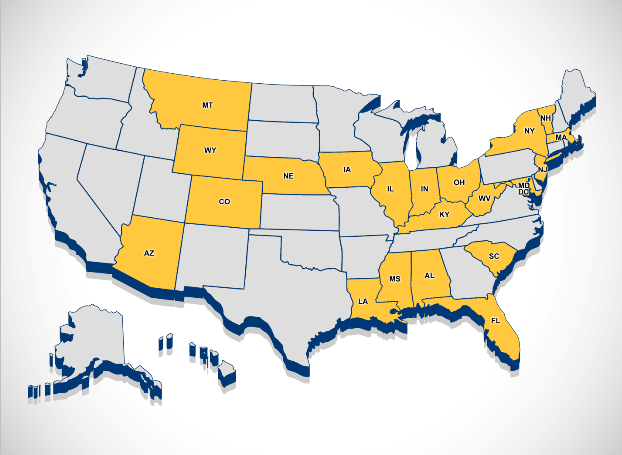

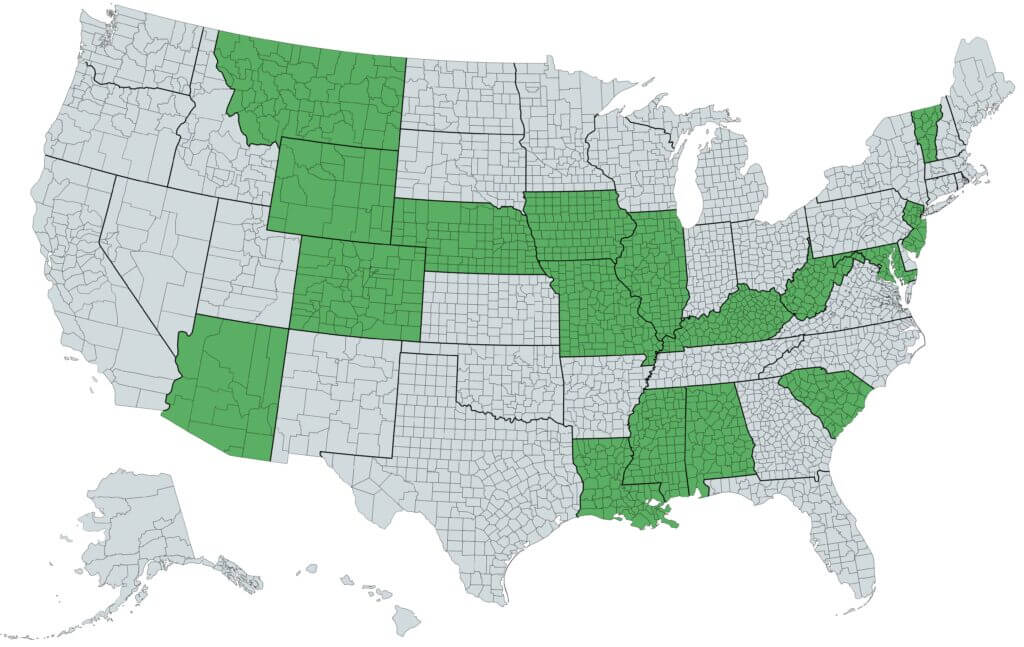

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Grandpa A Sons First Hero A Daughters First Love Love T Shirt T Shirt Shirts

Common Irs Audit Triggers Bloomberg Tax

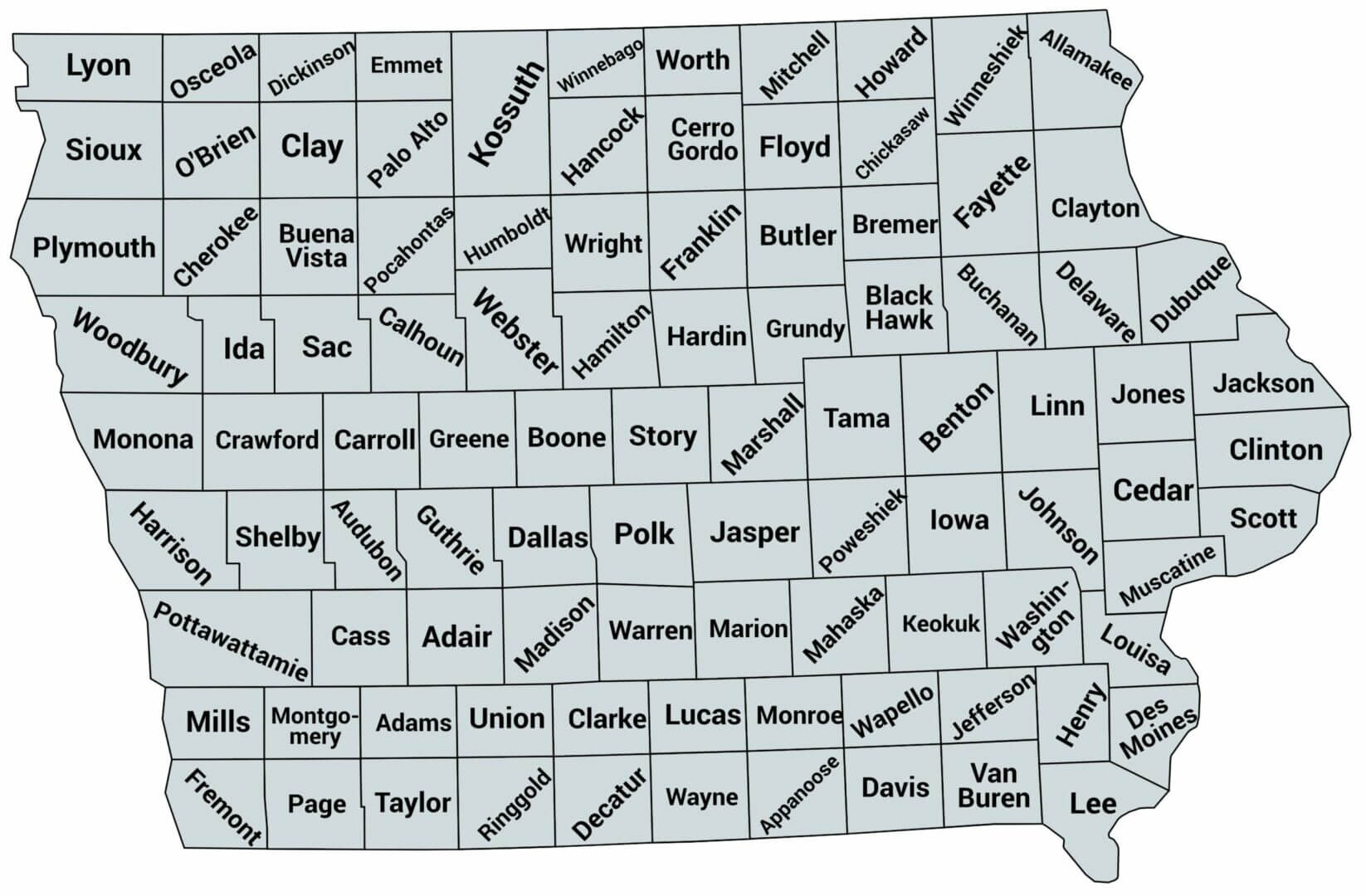

Do I Need To Collect Sales Tax For Online Orders Iasourcelink Iasourcelink

New Jersey Tax Sale Certificate Foreclosure Pscb Law New York And New Jersey Lawyers New Jersey Foreclosure Defense

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

What Assets Can The Irs Legally Seize To Satisfy Tax Debt Paladini Law

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)